High Tech vs. Deep Tech

Translation from Original in Frankfurter Allgemeine

Hermann Simon, a recent guest of The Value Creators podcast, illustrates the value generation capacity of so-called small and medium enterprises in this analysis of German industrial companies.

They may not be “big tech” like Google and Amazon, but they’re Deep Tech – deep in the value chain, secretly but crucially underpinning the visibility of big tech firms.

Hermann Simon1:

Is Germany an innovation failure? Quite a few people answer this question with “Yes!”. And indeed, there are enough case studies where Germany has little to offer on the subject of innovation. There is not a single German company that plays in the global league of consumer digitalization. We have nothing comparable to Google, Facebook, Apple, or Amazon. We also lag behind in digitization in public sectors such as administration or healthcare. One could also cite SpaceX, Elon Musk’s rocket company, as evidence of German innovation failure. Rockets are mechanical engineering applied to space and there were times when Germany was the technological leader. Musk started virtually from scratch with SpaceX in 2002 and is now the leading private provider of rocket transport to space. And the latest sensation in artificial intelligence, ChatGPT, significantly does not come from Germany either.

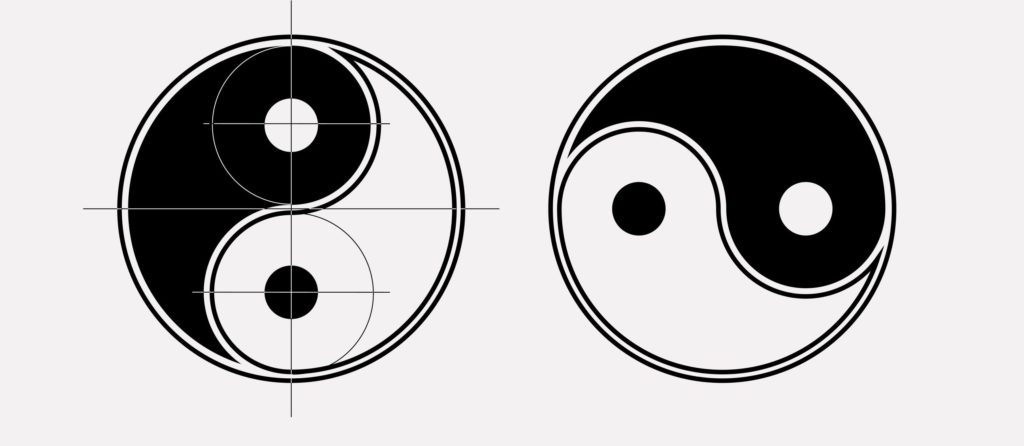

High-Tech

We speak of these innovations as high-tech, a designation that has a symbolic character. These innovations loom large in the landscape, like high mountains. Everyone knows them, everyone sees them. I dare to predict that in areas such as mass digitization, artificial intelligence, space travel, or defense technology, i.e. in symbolic high-tech, we will continue to be innovation failures in the future. Because there are reasons for the fact that we have little to show there so far. Uber tested its system in San Francisco for a few years and then rolled it out more or less unchanged to all major American cities. If someone wants to test such a system in Berlin and then expand it to Europe, they have to overcome 27 bureaucracies and languages. In other words, it is very unlikely that systems of mass digitization will emerge in Germany and become the global standard. It is not enough for a FAZ headline to say, referring to the Heidelberg start-up Aleph Alpha, “Germans keep up with ChatGPT” because it is by no means just about keeping up technically, but about assertiveness in the world.

In the case of space and defense technology, things don’t look much better. The American defense budget is 13.5 times that of Germany. The American space agency spends 24 billion dollars a year, and the German contribution to the European space agency amounts to 955 million euros. And one thing should be clear: the Americans will not buy these technologies in Germany or Europe. The German market is simply too small for a supplier operating from here to achieve a world-leading role.

Another reason for innovation failure is the often one-sided and, moreover, state-supported engineering orientation. This attitude is too optimistic about the obstacles to large-scale implementation and misjudges the economic viability. I cite as examples the Suprenum supercomputer, the Cargolifter, the Transrapid, or – at the European level – the Concorde. Some current projects for electric aircraft also have a good chance of joining this category. Innovation is not only technology, it also requires economic success.

Time and again, attempts are made by the state or initiated by associations and interest groups to finally do better in future-oriented areas. At the moment, these include artificial intelligence and quantum computing. The Federal Agency for Leap Innovations SPRIND, founded in 2019, is one such initiative. It has a budget of 180 million euros in 2023. The comparable American agency DARPA can spend $4.1 billion in the same year, 23 times as much. A European project for quantum computers is currently being launched, in which the EU wants to raise one billion euros by 2030 (see FAZ 6. 2. 2023). Google alone has announced investments of several billion dollars for this topic. Not to mention the Chinese when it comes to artificial intelligence and quantum computing.

As an interim conclusion, it should be noted that Germany is indeed an innovation failure in many modern fields. This is not only due to obstacles such as data protection or overregulation, which of course play a role. More important, in my view, are the objective demand conditions that in certain markets objectively stand in the way of Germany achieving global success or setting global standards.

Should we, therefore, throw in the towel? Not at all, because Germany is by no means an innovation failure in many areas, but a very successful innovation winner. These are not mass markets of digitalization or state-specific markets such as defense and space, but very specific industrial applications. When I ask at presentations how many suppliers Apple has in Germany, the estimates typically range between zero and 20. The true number is 767, in words sixty-seven! Hardly any of these suppliers are known to the public; practically all of them are hidden champions. These include the German-Swiss software LSTM (Long Short Term Memory) developed by Professor Jürgen Schmidhuber, which is behind Apple’s Siri system and installed on more than 3 billion smartphones. Celonis from Munich is the world market leader for so-called process mining and is valued at 13 billion euros. Deepl from Cologne delivers the best translations in the world, as proven in many tests. And behind the world monopoly of the Dutch company ASML for Extreme Ultraviolet Lithography are two key German suppliers, Trumpf and Zeiss. Trumpf’s laser generates a peak power of 20 gigawatts and a temperature of 220,000 degrees Celsius. Every second, 50,000 tin drops are shot onto the chip with the help of this device, which consists of 457,329 components and weighs 17.9 tonnes. The optical system from Zeiss is almost even more complex. It shortens the distance on the chips from 193 to 13 nanometres and thus extends Moore’s law by at least ten years. With its help, 56 billion transistors can be placed on the surface of a fingertip. Polishing the mirrors takes a year. If the mirrors were extended to the area of the Federal Republic, the deviation would be one millimeter. Experts speak of the “most complex machine in the Cold Technology War. This is not Rocket Science, they say, but much more complex.” The business ecosystem of ASML, Trumpf, and Zeiss allows for the management of complexity that no single company involved could manage. This approach can also be groundbreaking for small companies. MK Technology in Grafschaft/Eifel has only about 30 employees but manufactures highly complex investment casting systems. Six of these systems do the work at SpaceX that would otherwise require 1,000 large 3D printers. The extremely complex combustion chambers for the SpaceX rockets are manufactured on these systems. MK manages this because it cooperates with partners from China, Israel, France, and Germany as part of a business ecosystem.

Outside of physics and engineering, we also find many examples of outstanding innovation. Taifun Tofu is the European market leader for tofu. Tofu is made from soy. Normally, soya beans do not grow in Germany. In cooperation with the University of Hohenheim, Taifun has developed a soy variety that thrives in Germany, thus creating a domestic raw material base. This development took ten years. KWS AG, the world market leader in seed specialties, employs more than 2,000 people in research and development. BionTech can also serve as a model for future-oriented strategy. BionTech was founded in 2008, so it is not a young start-up company. Without the cooperation with the pharmaceutical giant Pfizer, BionTech would not have been able to roll out its technology on a global scale. Founding entrepreneurs who have a basic technical and scientific innovation that requires huge financial and organizational resources to exploit on a global, large-scale industrial scale should think of a similar business ecosystem instead of making a quick buck by selling it.

Deep-Tech

These are the kinds of innovations I call deep-tech, as opposed to high-tech. They are barely visible, who had heard of mRNa before Covid 19? These innovations move underwater or underground, so to speak. In the literal sense, this applies, for example, to the pipeline inspection systems of the German-Swiss world market leader Rosen Group. That is depth in the literal sense. But depth can certainly refer to different aspects, the most important of which is depth of knowledge. Many hidden champions are extremely focused and have deep knowledge. One world leader makes vacuum pumps in which the distance between the rotor and the casing is less than a third of a human hair. No other company in the world has mastered this capability. The depth here is in the experience of the engineers and the production staff. Depth, moreover, can be rooted in time. If it took Zeiss more than 20 years to develop its EUV optical system, competitors will have a hard time catching up. And the same applies to the ten years it took to develop Typhoon Tofu because biological processes cannot be accelerated at will. Thirdly, it is about depth in the value chain. If Apple has 767 suppliers in Germany, then these are distributed quasi-invisibly over the many stages of the extremely complicated value chain for electronic chips, sensors, and everything that goes with them. Beiersdorf and Henkel supply dozens of highly specialized adhesives for the phone, each of which fulfills a different function.

Conclusion

Unfortunately, our initial question “Is Germany an innovation failure?” must be answered in the affirmative for certain markets. These markets include, for example, spectacular high-tech areas such as mass digitization, space travel, or defense technology. These markets are characterized by conditions in which we do not have the capacity to set world standards. We should therefore keep our hands off such markets and not launch futile government funding initiatives. Or, like BionTech, we find partners, preferably in America, who have the resources to lead a basic technology to global market success.

Our preferred field should be deep-tech applications. These are more likely to be found in B2B products and processes than in B2C. To be successful in deep tech requires a great deal of depth, which can be based on competence, in time, or in the complexity of the value chain. Can we live with that? I think so, because even in the old world our strengths were not in consumer products and services. We never had world-leading consumer goods companies like Coca-Cola, Procter & Gamble, McDonald’s, Starbucks, or Marriott. But we were and are leaders in industrial products and processes, not in spectacularly visible high-tech, but in hidden deep-tech. If we expand and defend our competitiveness there, it can be enough to bring lasting prosperity to a country that makes up only one percent of the world’s population.

1 Prof. Dr. Dr. h.c. mult. Hermann Simon is founder and honorary chairman of Simon-Kucher.

Responses