22. Steven Phelan on Managing Expectations

Entrepreneurs operate in the future. They imagine a future where lives are improved because dissatisfactions are removed and there’s greater well-being to enjoy. Everyone can embrace that future. So what could go wrong?

Well, your customer may expect more than they feel they actually get, so they stop being a customer. Investors and bankers may expect you to get to your next milestone faster, putting you in a race to recover their confidence. Suppliers may expect a better relationship than they actually experience, and they become more difficult to deal with. And heck, you didn’t expect all this angst, so you are dealing with your own disappointments.

What’s the commonality here? Mis-managed expectations. Steve Phelan reckons you might spend half your time as an entrepreneur on the task of expectations management. If you can do it well, it’s a resource for you. Follow these management steps.

To comment, ask questions or interact in any way, join us at mises.business/group, our LinkedIn Group Page.

Show Notes

Definition: Expectations management is actively and purposefully changing someone’s opinion about the value of a resource or asset.

For example, many start-up or growing businesses suffer from a perception liability of newness or smallness. Target customers or potential investors or even potential employees might have a negative expectation about the company’s future prospects, which might present a barrier to securing capital or resources. You need to overcome the risk premium of smallness/newness in their eyes. You do so through expectations management.

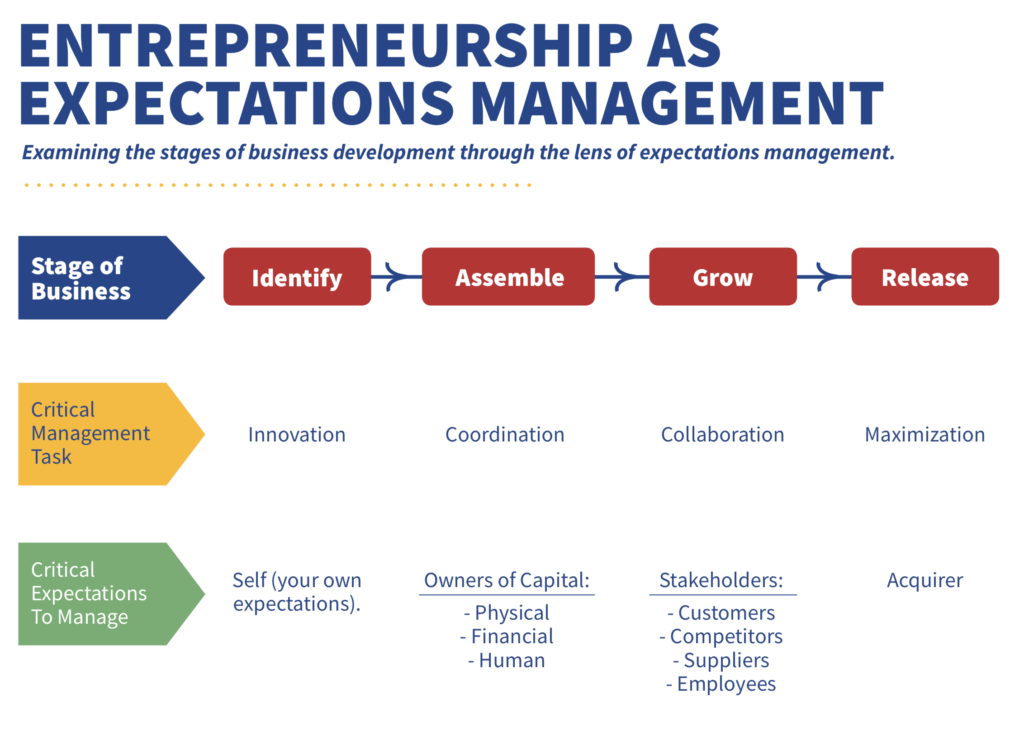

At the outset, when you are identifying your entrepreneurial opportunity and polishing your idea for a new business, a new project, or a new expansion phase, the expectations that most require management are your own. Get help.

Entrepreneurs are confident, action-oriented people. Confidence is good – but research indicates that entrepreneurs are often over-confident about their plans. Steve Phelan calls this the Identification Phase, the point at which the entrepreneur forms the belief that arranging a new set of resources to serve customers in new and better way will achieve a profit.

While start-up entrepreneurs tend to over-confidence, those in business over 5 years tend to demonstrate tighter control over their expectations about what’s possible. So experience can be a good expectations management tool. But, if you don’t have the experience, try to gather more perspective from people who have. Assemble an extended team, even if it’s only by e-mail or Slack. Ask them to share their experience to substitute for your own experience gaps.

When you’re assembling resources, your goal is to give the right impression of a solid plan, trustworthy management, and a well-paced path to profits.

Your target audience may be investors, whether friends and family or venture capital, or credit providers, like banks. In addition to the quality of your plan, your ability to manage expectations is also influenced by soft skills such as presentation style, and environmental variables such as how you dress. As always, the entrepreneur’s go-to tool is empathy. Take the time to learn about your audience’s history and preferences and form a clear idea about their goals and motivations. VC’s are portfolio managers – show them you fit. Bankers want zero defaults – assure them you can easily clear that bar.

If you are managing potential employees’ expectations, try to be sure you know how they form them. Are they thinking about future equity and getting rich? Or is security a higher preference for them? What about commuting versus working from home? What improvement over their current job are they are expecting? In order to manage expectations, you need to know and understand what the target audience expects.

In your growth phase, expectations management shifts to customers. They form their expectations entirely subjectively, and your task is to align with them emotionally.

Austrian economists understand that it is customers who create value – it’s a consequence of their satisfaction, which only they can determine. In fact, they form satisfaction expectations in advance, based on your value proposition. If their experience is less than their expectation, they’ll be disappointed, even if your product or service performed well. Therefore, expectations management with customers is a matter of alignment.

If you operate a B2B business, the alignment vector is always trust. Customers are taking a risk when they embrace a new supplier or a new idea or a new product. Trust helps them embrace that risk. What is the signal of trust that will make the difference? Can it be influenced by guarantees or warranties? How can you demonstrate that the service level you promise will be the service level you deliver? And take the time required to identify the customer’s transaction cost (the cost of taking on a new supplier) and opportunity cost (what’s the alternative to your service). Be sure to address those two costs directly.

At some point, you will prefer to release assets. This is the time to manage expectations upwards.

The exit stage may apply to selected assets – for example, you may want to reshuffle your capital structure by selling some and buying others – or you may be exiting a business by selling it. Steve Phelan had two pieces of advice for the exit stage. One was directed at the entrepreneur’s own expectations – to think about exit at the purchase stage (“making money on the buy”) so that there’s an advance plan for a realistic exit price. The second was to let multiple bidders be the influencers of each other’s expectations. Otherwise, you’ll need a strong case to manage expectations to be higher than the market average. For a hard asset, you may have to demonstrate how your ownership was a positive contributor to value – e.g. a superior maintenance regimen. For a financial asset, you may have to demonstrate the opposite – that new ownership can get a higher return. For example, entrepreneurs selling a business to a strategic buyer must create the expectations that the greater resources of the new owner can accelerate growth, reduce costs or increase profitability.

Do’s and don’ts.

Manage expectations every day. Where are they set in the minds of others? Do they need adjusting?

Don’t create negative expectations (e.g. by failing to meet deadlines or over-promising). Don’t ignore inputs or advice. Don’t set expectations that can’t possibly be attained.

Your brand is not just your promise. It’s keeping your promise.

DOWNLOAD

Download the Entrepreneurship as Expectations Management PDF (88 KB)

Download the Entrepreneurship as Expectations Management PDF (88 KB)

Responses